Capital Allowance Claim Service:

One great way of saving our clients’ money, which is often overlooked, is to ensure that they have claimed back all qualifying capital allowances within their commercial properties.

The Aftersales Network has therefore teamed up with the leading expert in this specialist field of Capital Allowance refunds on commercial property.

Capital Allowance Claim Service:

It is estimated that 18 billion pounds in capital allowances are claimed each year from HMRC, the staggering fact is that over 94% of commercial property owners have not yet claimed their full allowances and therefore are missing out on substantial legitimate tax savings

Typical values found (% of purchase price not current value)

Modern Offices 35% -55%

-55%

Office Refurbishments/Fit-outs 45%-75%

Hotels 35%-55%

Restaurants 20%-35%

Industrial Units 15%-20%

Retail Units 25%-50%

Vehicle Dealerships 35%-50%

If you own commercial property there is an estimated 96% chance you qualify for a substantial income tax or corporation tax refund.

When you spend money buying or improving a property, HMRC allows you to offset some of that expenditure against your profits or general income for tax purposes.

They are available to anyone buying, building or improving commercial property.

Owners and Tenants of commercial property who have incurred capital expenditure either buying or refurbishing their property are eligible to claim back in most cases substantial tax rebates from HMRC.

This is not a contentious tax avoidance scheme or loophole but is based on established UK statutory law dating back to 1878 and defined within the Capital Allowance Act 2001.

When commercial properties are acquired they always contain items that should be classified as plant and machinery. However unless specialist surveyors are employed these items are often not reported on and the tax relief which can be legitimately requested against them goes unclaimed.

Capital allowances are available in respect of:

Most ‘plant and machinery’ used for business purposes;

Certain building works – for example converting space above commercial premises to flats for renting;

Certain research and development expenditure

Hot water systems

Radiators

Alarms

Fire equipment

Telephone installations

The above is not an exhaustive list. This merely provides an overview of the main types of capital allowances that can be claimed.

What are Capital Allowances?

Capital allowances are a form of tax relief that enable the cost of capital assets to be written off against the taxable profits of a business.

They are given in lieu of depreciation charged in the commercial accounts, which is not usually allowed for tax purposes.

They can be claimed by anyone (either property owner or tenant) who is a UK taxpayer and has incurred capital expenditure on buying, developing, refurbishing or fitting out commercial property.

HMRC do not publicise these allowances, indeed they will only accept submissions in a pre-approved format which complies with very strict rules.

About our Service

Most commercial property owners take it for granted that their accountants would have already made provision in their accounts for claiming back unclaimed capital allowances.

In reality most accountants are aware of what capital allowances are and some may even make a notional allowance for them in their clients tax computations but this can however often lead to significant ‘under-claiming’ of the relief.

The way in which many of the allowances are given requires a detailed understanding of both construction processes and valuations, for such work to be done accurately and – more importantly – accountably.

It is advised that a specialist Capital Allowance Surveyor be appointed, this is where we step in and offer our specialist report writing services to make sure you receive your full entitlements.

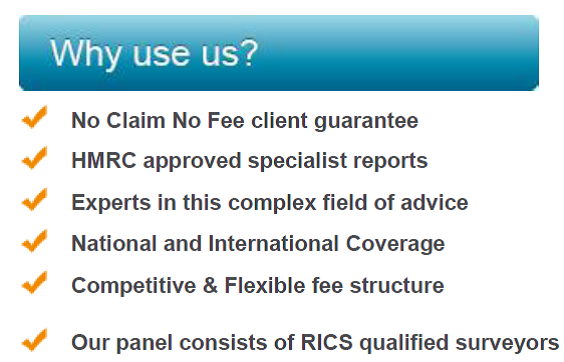

The Aftersales Network has negotiated a

No Claim No Fee Guarantee for our clients.

So if you feel![]() you may benefit from this service please give us a call or complete the online enquiry below and we will be more than happy to explain the process in more detail with you.

you may benefit from this service please give us a call or complete the online enquiry below and we will be more than happy to explain the process in more detail with you.

Data Protection:

We are committed to protecting your privacy and recognise our responsibility to keep the information you provide to us confidential at all times.